|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Chapter 13 Bankruptcy in Florida: Quick Facts and Insights

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy, often referred to as a wage earner's plan, enables individuals with regular income to develop a plan to repay all or part of their debts. It is a powerful legal tool for those struggling to manage their financial obligations while retaining their assets.

Who Can File?

To be eligible for Chapter 13 bankruptcy in Florida, individuals must meet certain criteria. You must have a steady income and not exceed specific debt limits. For a deeper understanding of the eligibility requirements, you may also want to explore chapter 7 bankruptcy income limits as these can provide insight into related constraints.

The Filing Process

Filing for Chapter 13 bankruptcy involves several steps, including credit counseling and the creation of a repayment plan.

- Credit Counseling: Mandatory counseling from an approved agency must be completed before filing.

- Filing the Petition: You'll need to submit a petition and other necessary forms to the bankruptcy court.

- Repayment Plan: Propose a feasible repayment plan to pay back creditors over three to five years.

During the repayment period, debtors can focus on maintaining payments under the plan, knowing that their assets are protected.

Benefits of Filing Chapter 13

Chapter 13 offers several advantages, especially for those facing foreclosure or repossession.

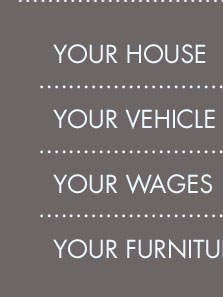

- Asset Retention: Unlike Chapter 7, Chapter 13 allows debtors to keep their homes and cars.

- Debt Consolidation: It simplifies debt payments by consolidating them into a single monthly payment.

- Co-Debtor Protection: Offers protections for co-signers on consumer debts.

For those considering alternatives, it's useful to compare the benefits with chapter 7 bankruptcy in Georgia, which offers a different approach to debt relief.

Frequently Asked Questions

What is the difference between Chapter 13 and Chapter 7 bankruptcy?

Chapter 13 bankruptcy involves a repayment plan to pay back debts over time, allowing you to keep your assets. Chapter 7, on the other hand, involves liquidating non-exempt assets to pay off creditors and is quicker but may result in losing some property.

Can I discharge all debts with Chapter 13 bankruptcy?

No, not all debts can be discharged. Chapter 13 typically addresses secured debts and priority debts like taxes, while some debts like child support and student loans are generally not dischargeable.

How long does Chapter 13 bankruptcy stay on my credit report?

Chapter 13 bankruptcy can remain on your credit report for up to seven years from the date of filing, which is less than the ten years for Chapter 7.

After you file for bankruptcy, you are given a case number and a Notice of Bankruptcy Case Filing, which you can use to prove to any creditor that you are under ...

Filing a Chapter 13 bankruptcy means you need to use your income to repay all or some of what you owe to creditors over three to five years.

Chapter 13 allows homeowners to force the bank to accept a 5-year payment plan for the past due amount. The homeowner won't have to pay the full ...

![]()